Appearance

Roadmap & Future Vision

Roadmap & Development Plan

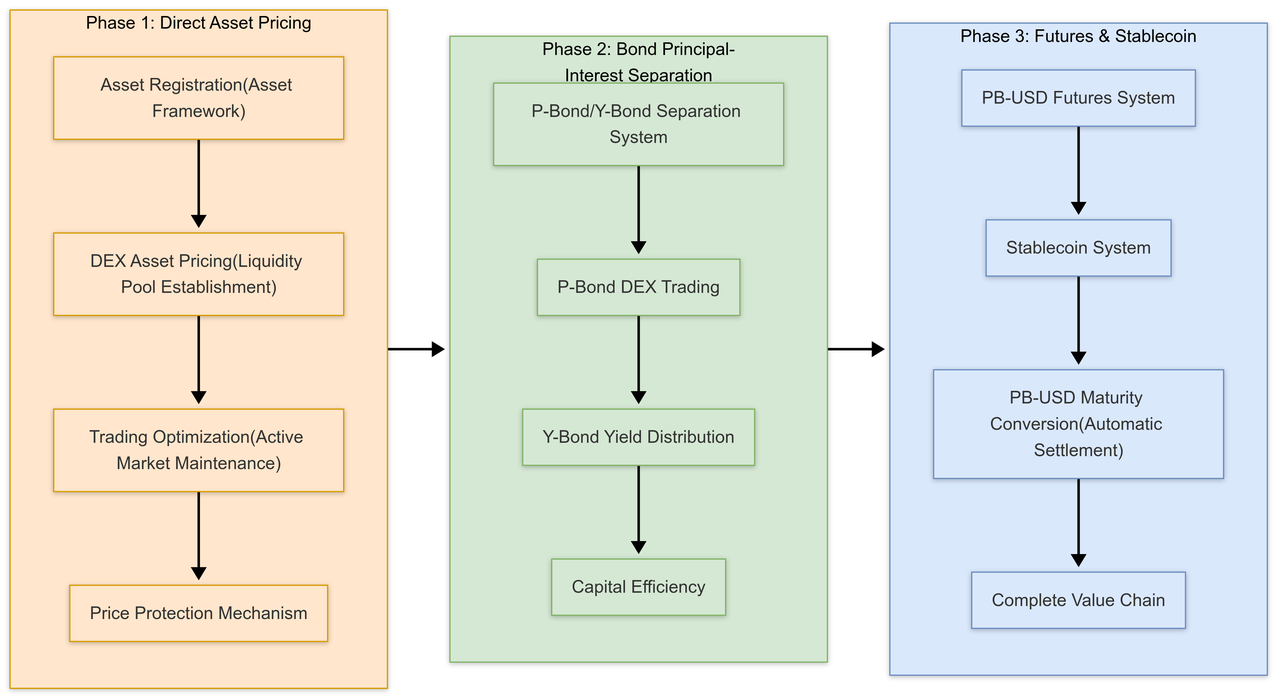

The IOST 3.0 implementation follows a comprehensive development plan with clear milestones and deliverables. This roadmap outlines the timeline, key activities, and success metrics for each phase.

Phase 1: Foundation Development (Q1-Q2 2023)

Core Activities:

- Deploy asset management framework

- Establish DEX integrations

- Develop basic trading functionality

- Build analytics infrastructure

Key Deliverables:

- Asset registration framework with multi-asset support

- Initial DEX liquidity pools

- API infrastructure for external integrations

- Technical documentation and developer resources

Success Metrics:

- Support for 5+ asset types

- Stable DEX operations with minimal slippage

- API uptime exceeding 99.9%

- Developer onboarding time under 2 days

Phase 2: Bond Separation Engine (Q3-Q4 2023)

Core Activities:

- Deploy Liquidity Engine core components

- Implement P-Bond/Y-Bond separation mechanisms

- Develop yield management systems

- Create maturity management framework

Key Deliverables:

- Complete bond separation functionality

- P-Bond trading mechanisms

- Y-Bond yield distribution system

- Staggered maturity implementation

- Advanced user interfaces for bond management

Success Metrics:

- Bond separation processing time under 3 seconds

- Y-Bond yield calculation accuracy within 0.01%

- Support for multiple maturity schedules

- P-Bond pricing efficiency vs theoretical models

Phase 3: Financial Instruments (Q1-Q2 2024)

Core Activities:

- Develop PBDUSD system

- Implement DUSD stablecoin infrastructure

- Create cross-chain bridges

- Build advanced market tools

Key Deliverables:

- PBDUSD staking and generation mechanisms

- DUSD minting/burning functionality

- Complete value transfer chain

- Cross-chain asset support

- Advanced analytics dashboard

Success Metrics:

- Transaction finality under 2 seconds

- Price stability of DUSD within ±0.1% of target

- Cross-chain operation success rate exceeding 99.5%

- System able to handle 1000+ TPS

Phase 4: Ecosystem Expansion (Q3-Q4 2024)

Core Activities:

- Integrate with external platforms

- Expand asset types

- Develop advanced financial products

- Implement governance mechanisms

Key Deliverables:

- SDK for third-party integrations

- Expanded asset support

- Advanced derivative products

- DAO governance implementation

- Institutional-grade compliance tools

Success Metrics:

- 50+ integrated partners

- 20+ supported asset types

- Weekly active users exceeding 50,000

- Monthly transaction volume growth of 15%+

Long-term Vision (2025 and beyond)

Strategic Directions:

- Expansion to additional blockchain networks

- Development of AI-driven portfolio optimization

- Integration with traditional financial infrastructure

- Creation of institutional-grade financial products

This roadmap represents our commitment to building a comprehensive financial infrastructure that transforms how assets are managed, traded, and utilized. Each phase builds upon the previous one, creating a progressively more powerful and versatile ecosystem.

Conclusion & Future Vision

IOST 3.0 represents a paradigm shift in financial infrastructure, fundamentally transforming how assets are managed, traded, and utilized. By introducing innovations like bond principal-interest separation, advanced liquidity tools, and seamless cross-chain integration, we've created a foundation for the next generation of financial services.

Key Accomplishments

The IOST 3.0 architecture successfully delivers on its core objectives:

- Creating a complete bond separation ecosystem that dramatically improves capital efficiency

- Enhancing asset liquidity through innovative financial instruments

- Establishing seamless cross-chain asset integration

- Building a transparent and reliable value transmission chain

- Providing intuitive interfaces for both institutional and individual users

These accomplishments represent significant advancements in blockchain-based financial infrastructure, overcoming limitations that have previously hindered adoption and utility.

Future Directions

Looking forward, IOST 3.0 will continue to evolve along several strategic vectors:

1. Expanded Asset Integration

- Incorporating additional asset classes and financial instruments

- Deepening integration with traditional financial markets

- Supporting novel asset types as they emerge

2. Enhanced Financial Tools

- Developing more sophisticated yield optimization strategies

- Creating advanced risk management instruments

- Building predictive analytics for portfolio construction

3. Ecosystem Growth

- Fostering a developer community around the platform

- Supporting third-party applications and services

- Establishing strategic partnerships with financial institutions

4. Technical Advancement

- Implementing cutting-edge consensus improvements

- Enhancing cross-chain security and efficiency

- Incorporating AI for advanced market analysis

Final Perspective

IOST 3.0 is not merely a technical platform—it's a financial revolution that democratizes access to sophisticated financial tools while dramatically improving efficiency for all participants. By reimagining the foundational infrastructure of asset management and trading, we're creating new possibilities for both traditional finance and the emerging decentralized economy.

Our vision extends beyond the current implementation to a future where capital flows freely, efficiently, and securely across all markets, empowering users at every level to achieve their financial goals. IOST 3.0 represents a crucial step toward that vision—a bridge connecting today's financial reality with tomorrow's possibilities.