Appearance

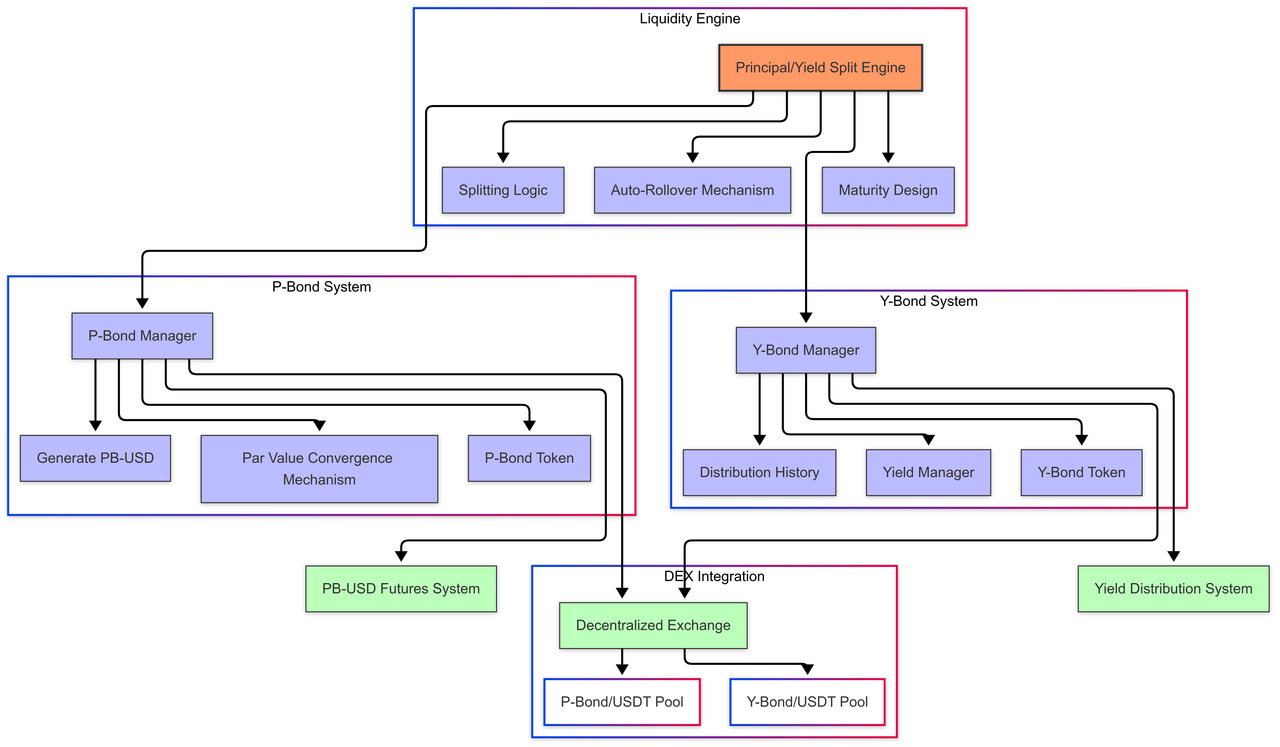

Liquidity Engine (Principal/Yield Separation Engine)

Functionality Description

The Liquidity Engine is the core innovation component of IOST 3.0, implementing principal-interest separation of bonds and revolutionizing the operation mode of traditional bond markets. It separates bonds into principal components (P-Bond) and yield components (Y-Bond), significantly improving capital utilization efficiency, enhancing liquidity, and meeting the needs of investors with different risk preferences.

Core Components

Separation Engine

- Function: Separates bond assets according to optimized ratios

- Technical Features: Smart separation algorithms, automatic calculation of optimal separation ratios

- Innovation Points: Supports multiple separation ratio configurations, default 95:5 (principal:yield)

- Application Scenarios: Institutional asset portfolio optimization, yield stream separate trading

P-Bond Manager

- Function: Manages the complete lifecycle of principal bonds (P-Bonds)

- Technical Features: Automatic maturity conversion mechanisms, par value convergence algorithms

- Innovation Points: Multi-term strategies, gradient maturity design

- Application Scenarios: Principal-protected investments, liquidity planning

Y-Bond Manager

- Function: Manages yield bonds (Y-Bonds) and their yield streams

- Technical Features: Yield calculation and prediction models

- Innovation Points: Yield stream optimization and risk adjustment

- Application Scenarios: High-yield pursuit investments, yield stream trading

Technical Highlights

Capital Efficiency Multiplication

- Unlocks idle capital in fixed-income assets

- Separates yield streams, enabling double utilization of capital

- Improvement in capital efficiency

Fine-Grained Risk Allocation

- P-Bonds provide lower risk with par value recovery guarantees

- Y-Bonds provide higher risk with higher return potential

- Meets the needs of investors with different risk preferences

Enhanced Liquidity

- Separated bond components have greater liquidity than whole bonds

- Promotes secondary market activity

- Reduces trading friction and slippage costs

Maturity Strategy Optimization

- Staggered maturity design avoids liquidity shocks

- Automatic rollover mechanisms maintain long-term stability

- Supports early exit options, enhancing flexibility

Key Interfaces

splitBond()- Separates assets into P-Bond and Y-BondgetPBondInfo()- Gets P-Bond details (value, maturity date)getYBondInfo()- Gets Y-Bond details (yield rate, distribution history)calculateSplitRatio()- Calculates optimal separation ratiogetMaturitySchedule()- Gets maturity schedule