Appearance

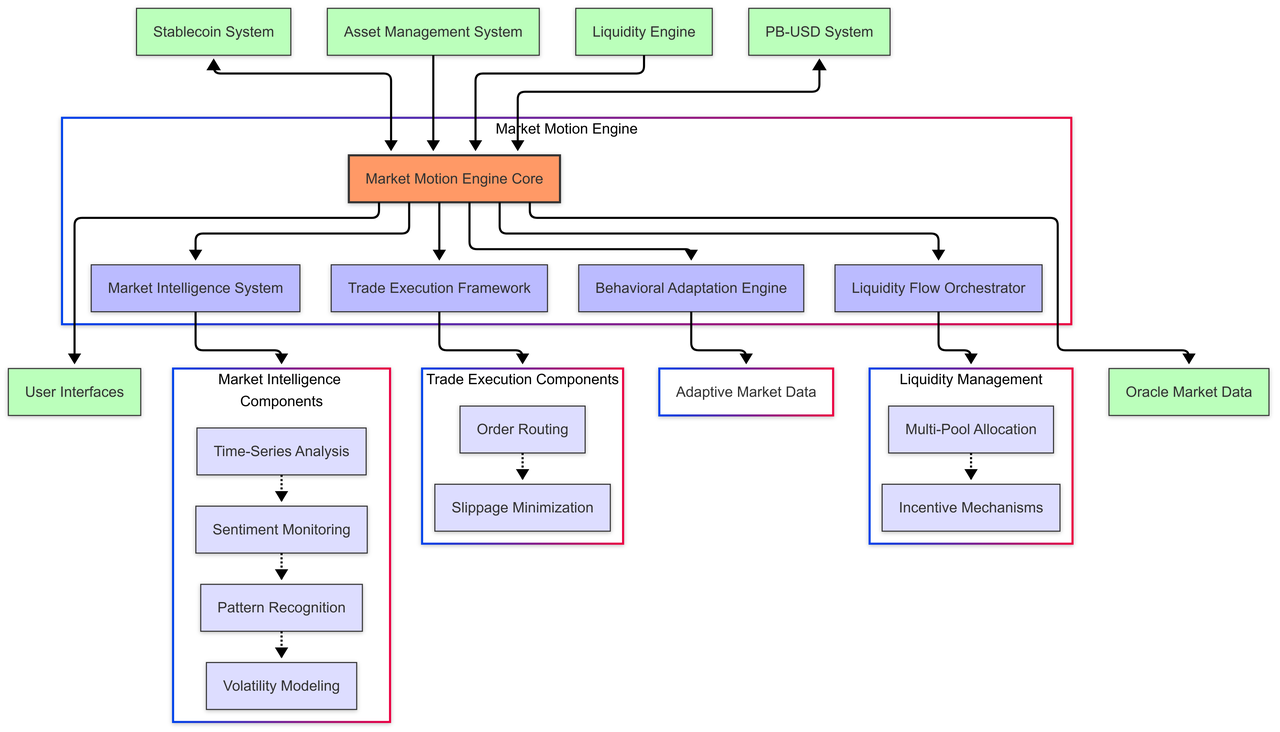

Market Motion Engine

Functionality Description

The Market Motion Engine serves as the dynamic intelligence layer of IOST 3.0, orchestrating market operations, trade execution, and data-driven decision making across the platform. This system combines advanced market analytics, intelligent trade routing, and behavioral optimization to ensure smooth, efficient, and responsive market mechanics for all ecosystem participants.

Core Components

Market Intelligence System

- Function: Real-time market analysis and pattern recognition

- Technical Features: Advanced time-series analysis, sentiment tracking, cross-market correlation

- Innovation Points: Predictive volatility modeling, liquidity flow prediction, market regime detection

- Application Scenarios: Investment strategy optimization, risk management, market timing

Trade Execution Framework

- Function: Optimizes order execution and routing

- Technical Features: Path-finding algorithms, slippage minimization, MEV protection

- Innovation Points: Dynamic fee optimization, cross-pool liquidity aggregation, timing optimization

- Application Scenarios: Large order execution, arbitrage opportunities, time-sensitive transactions

Adaptive Market Data Engine

- Function: Learns and adapts to changing market conditions

- Technical Features: Real-time learning algorithms, adaptive parameter tuning

- Application Scenarios: Volatile market navigation, flash crash warning, congestion management

Liquidity Flow Orchestrator

- Function: Optimizes capital deployment across the ecosystem

- Technical Features: Multi-pool allocation strategies, incentive mechanism design

- Application Scenarios: Liquidity crises prevention, market making efficiency, capital utilization

Technical Highlights

Intelligent Routing Capabilities

- Multi-path execution for large orders to minimize market impact

- Real-time rebalancing in response to changing liquidity conditions

- Cross-DEX aggregation for optimized execution

Adaptive Market Response

- Self-tuning parameters based on observed market conditions

- Automatic protocol adjustments during high volatility periods

- Counter-cyclical mechanism design to enhance market stability

Performance Optimization

- Transaction confirmation within 1.5 seconds for 99.5% of trades

- Memory-efficient state management for high throughput

- Prioritization system for critical market operations

Risk Management Integration

- Real-time position monitoring and risk assessment

- Circuit breakers for extreme market conditions

- Systemic risk detection across interconnected markets

- Multi channel oracle feeds to ensure market data authentication

Key Applications

Institutional Trading

- Large order optimization to minimize slippage and market impact

- Risk-constrained execution frameworks for fiduciary compliance

Market Making Activities

- Intelligent spread management based on market conditions

- Statistical arbitrage opportunities across correlated assets

Retail Trading Experience

- Best price discovery across fragmented liquidity pools

- Intuitive interfaces for complex trading strategies

System-Level Market Stability

- Proactive liquidity provision during market stress

- Cross-component coordination during high volatility

- Self-healing mechanisms for market dislocations

- Gradual adjustment policies to prevent sharp discontinuities

Key Interfaces

executeOptimalTrade(tradeParams)- Executes trades with optimal routing and timinganalyzeMarketConditions(assets)- Provides comprehensive market analyticsgetLiquidityDistribution(poolIds)- Maps liquidity across connected poolspredictPriceImpact(tradeSize, asset)- Estimates market impact before executionoptimizePortfolioExecution(portfolio, targetAllocation)- Plans efficient portfolio adjustmentsgetMarketRegimeMetrics()- Returns current market condition classification

The Market Motion Engine represents the intelligent central nervous system of IOST 3.0, continuously adapting to market conditions and optimizing operations across all components. By combining advanced analytics with adaptive execution strategies, it ensures that the entire ecosystem operates with maximum efficiency, stability, and responsiveness to changing market dynamics.