Appearance

Development Strategy

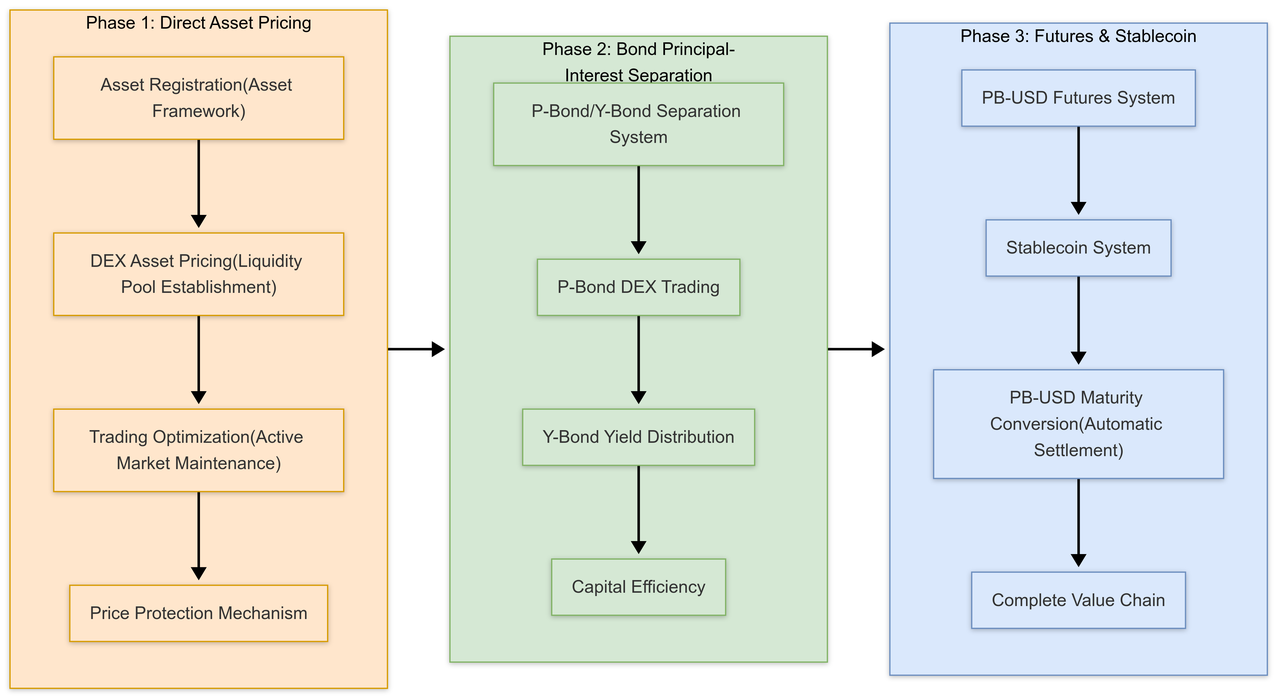

IOST 3.0 adopts a progressive development strategy, implementing the overall architecture in three phases:

Phase 1: Asset Management & Pricing Foundation

This phase focuses on establishing the infrastructure and asset pricing mechanisms:

Diversified Asset System

- Build standardized asset framework supporting multiple asset types

- Implement asset valuation and rating mechanisms

- Establish asset metadata and analysis interfaces

Asset Pricing System

- Build asset price discovery mechanisms

- Optimize liquidity allocation strategies

- Implement basic trading functions

Price Stability Mechanisms

- Design dynamic slippage protection mechanisms

- Implement smart liquidity management

Phase 2: Bond Principal-Interest Separation

This phase introduces the bond separation functionality of IOST Liquidity Engine:

P-Bond/Y-Bond Separation System

- Separate bond assets into principal (P-Bond) and yield (Y-Bond) components

- Design optimized separation ratios and structures

- Implement multi-term bond management

Bond Pricing System

- Establish P-Bond market pricing mechanisms

- Implement time-based price convergence algorithms

Yield Management System

- Design Y-Bond yield analysis and calculation tools

- Implement yield history and prediction displays

Phase 3: Financial Tools & Stablecoin Ecosystem

This phase completes the overall value chain:

PBDUSD System

- Develop P-Bond staking and PB-USD generation mechanisms

- Implement bond futures pricing and trading

DUSD Stablecoin System

- Implement 1:1 anchoring with mainstream stablecoins

- Build stablecoin minting and burning rules

Complete Value Chain

- Integrate all components to form a complete value transfer path

- Optimize price transmission mechanisms