Appearance

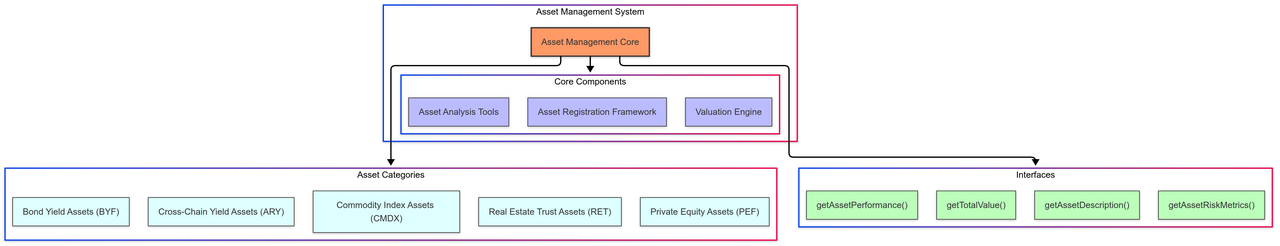

Asset Management System

Functionality Description

The Asset Management System is the foundation component of IOST 3.0, responsible for integrating and managing diversified assets, providing unified asset representation, valuation and management interfaces, and supporting asset lifecycle management and data analysis.

Supported Asset Categories

Cross-Chain RWA Yield Assets (ARY)

- Function: Aggregate multi-chain RWA yield strategies to optimize investment returns

- Technical Features: Cross-chain communication and yield optimization algorithms

- Application Scenarios: Institutional liquidity management, yield optimization strategies

Commodity Index Assets (CMDX)

- Function: Provide commodity market exposure and inflation hedging

- Technical Features: Commodity price oracles and index calculation models

- Application Scenarios: Portfolio diversification, inflation protection strategies

Bond Yield Assets (BYF)

- Function: Provide stable returns and fixed-term investment options

- Technical Features: Yield curve models and maturity management

- Application Scenarios: Income-oriented portfolios, risk hedging strategies

Real Estate Trust Assets (RET)

- Function: Provide real estate market investment and yield distribution

- Technical Features: Asset valuation models and dividend mechanisms

- Application Scenarios: Long-term asset allocation, income diversification

Private Equity Assets (PEF)

- Function: Provide early/growth stage enterprise investment opportunities

- Technical Features: Stage valuation models and liquidity optimization

- Application Scenarios: High-risk high-return investments, portfolio diversification

Core Technical Components

Asset Registration Framework

- Standardized asset onboarding process

- Multi-level asset classification system

- Extensible asset property configuration

Valuation Engine

- Multi-source data price aggregation

- Asset-specific valuation algorithms

- Risk-adjusted valuation models

Asset Analysis Tools

- Historical performance analysis

- Risk metrics calculation

- Correlation and volatility analysis

Key Interfaces

getTotalValue()- Get total asset valuegetAssetDescription()- Get detailed asset descriptiongetAssetPerformance()- Get asset performance metricsgetAssetRiskMetrics()- Get asset risk measurement data