Appearance

Roadmap & Development Plan

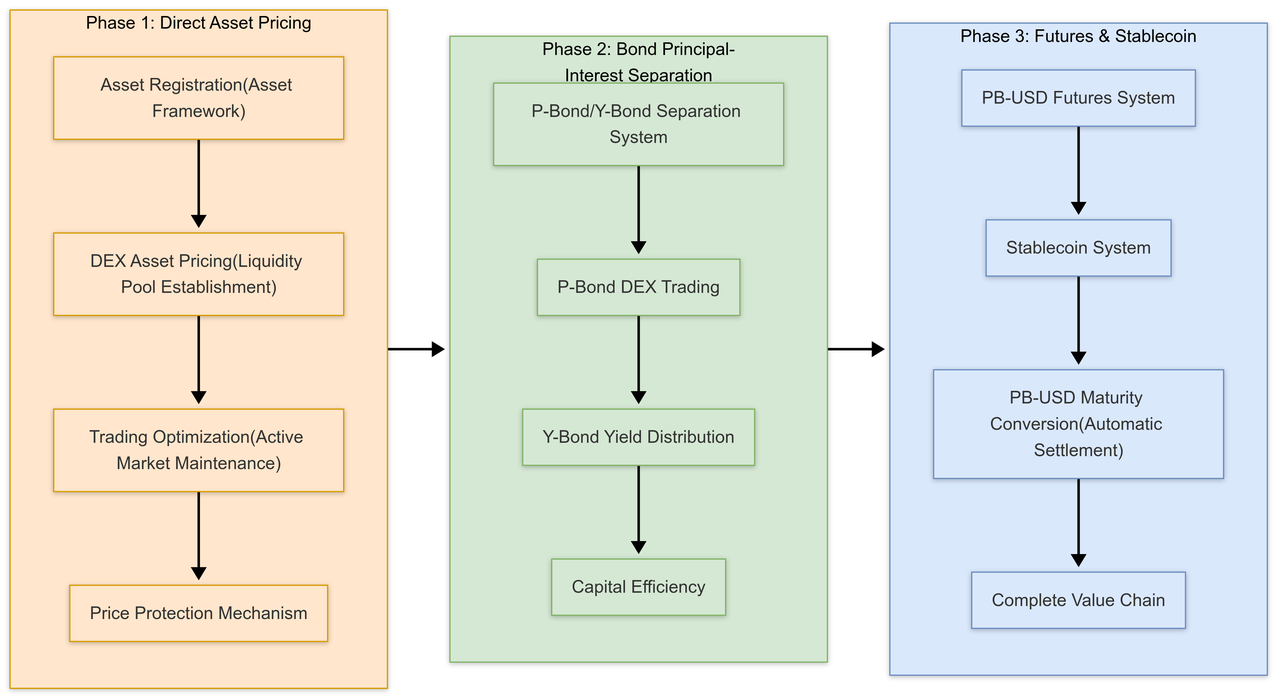

The IOST 3.0 implementation follows a comprehensive development plan with clear milestones and deliverables. This roadmap outlines the timeline, key activities, and success metrics for each phase.

Phase 1: Foundation Development (Q1-Q2 2023)

Core Activities:

- Deploy asset management framework

- Establish DEX integrations

- Develop basic trading functionality

- Build analytics infrastructure

Key Deliverables:

- Asset registration framework with multi-asset support

- Initial DEX liquidity pools

- API infrastructure for external integrations

- Technical documentation and developer resources

Success Metrics:

- Support for 5+ asset types

- Stable DEX operations with minimal slippage

- API uptime exceeding 99.9%

- Developer onboarding time under 2 days

Phase 2: Bond Separation Engine (Q3-Q4 2023)

Core Activities:

- Deploy Liquidity Engine core components

- Implement P-Bond/Y-Bond separation mechanisms

- Develop yield management systems

- Create maturity management framework

Key Deliverables:

- Complete bond separation functionality

- P-Bond trading mechanisms

- Y-Bond yield distribution system

- Staggered maturity implementation

- Advanced user interfaces for bond management

Success Metrics:

- Bond separation processing time under 3 seconds

- Y-Bond yield calculation accuracy within 0.01%

- Support for multiple maturity schedules

- P-Bond pricing efficiency vs theoretical models

Phase 3: Financial Instruments (Q1-Q2 2024)

Core Activities:

- Develop PBDUSD system

- Implement DUSD stablecoin infrastructure

- Create cross-chain bridges

- Build advanced market tools

Key Deliverables:

- PBDUSD staking and generation mechanisms

- DUSD minting/burning functionality

- Complete value transfer chain

- Cross-chain asset support

- Advanced analytics dashboard

Success Metrics:

- Transaction finality under 2 seconds

- Price stability of DUSD within ±0.1% of target

- Cross-chain operation success rate exceeding 99.5%

- System able to handle 1000+ TPS

Phase 4: Ecosystem Expansion (Q3-Q4 2024)

Core Activities:

- Integrate with external platforms

- Expand asset types

- Develop advanced financial products

- Implement governance mechanisms

Key Deliverables:

- SDK for third-party integrations

- Expanded asset support

- Advanced derivative products

- DAO governance implementation

- Institutional-grade compliance tools

Success Metrics:

- 50+ integrated partners

- 20+ supported asset types

- Weekly active users exceeding 50,000

- Monthly transaction volume growth of 15%+

Long-term Vision (2025 and beyond)

Strategic Directions:

- Expansion to additional blockchain networks

- Development of AI-driven portfolio optimization

- Integration with traditional financial infrastructure

- Creation of institutional-grade financial products

This roadmap represents our commitment to building a comprehensive financial infrastructure that transforms how assets are managed, traded, and utilized. Each phase builds upon the previous one, creating a progressively more powerful and versatile ecosystem.